Forex Pivot Points Explained FX Leaders

A pivot point is a is a technical indicator used by forex traders as a price level gauge for potential future market movements. The pivot point indicator is used to determine trend bias as.

How to Use Pivot Points? Trading Strategies + MT4 Indicator FXSSI Forex Sentiment Board

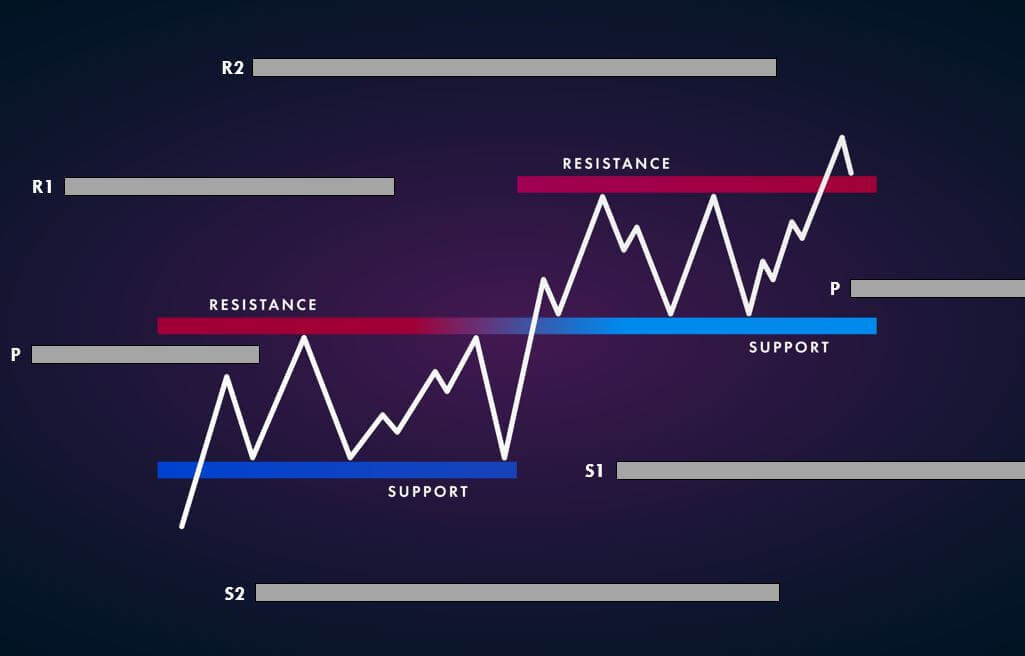

Trading Spot Forex with Pivot Points. The Pivot Point is a level in which the sentiment of the market changes from bullish to bearish or vice versa. If the market breaks this level to the upside.

Weekly Pivot Bounce Forex Trading Strategy

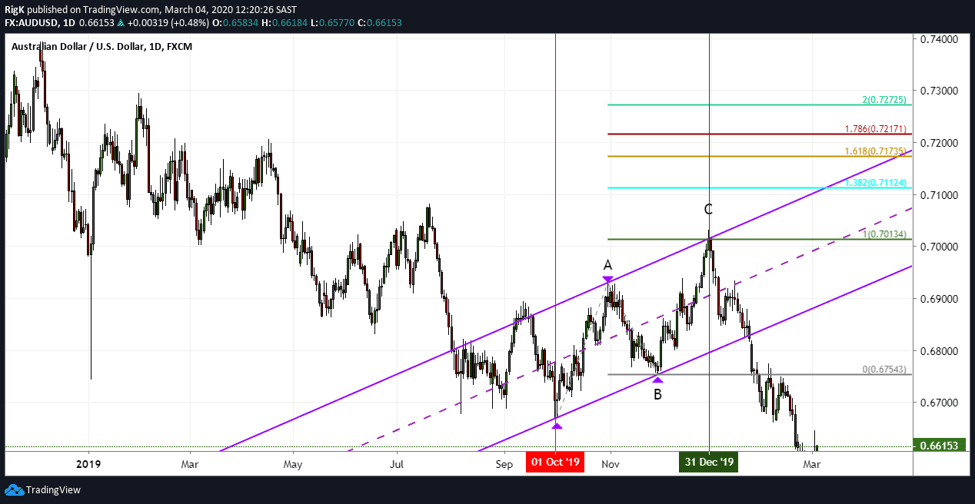

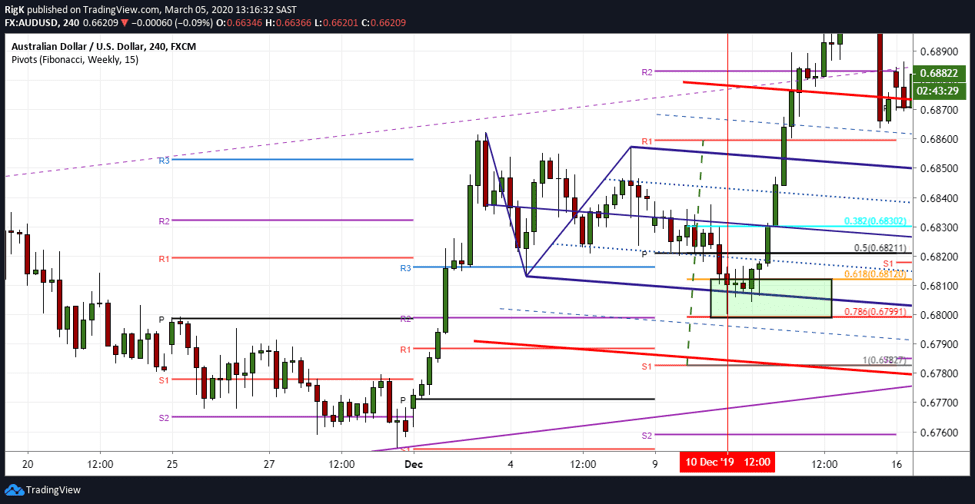

Pivot points are used by traders as a predictive indicator and denote levels of technical significance. When used in conjunction with other technical indicators such as support and resistance or Fibonacci, pivot points can be an effective trading tool. LEARN MORE ABOUT PIVOT POINTS Try a Demo Account Risk Free

Pivot Point Strategies for Forex Traders IG Community Blog IG Community

If the close is higher than the open: x = 2H + L + C. When the open is equal to the close: x = H + L + 2C. This final value will be the one more commonly used if you are looking at a Forex pivot point trading strategy. This is because with FX being a 24-hour market, the open is nearly always equal to the close.

What Are Pivot Points?

Pivots are also very popular in the forex market and can be an extremely useful tool for range-bound traders to identify points of entry and for trend traders and breakout traders to spot the.

Pivot Points Forex Tutorial Investing Post

Pivot point, support and resistance calculations are widely accepted as the simplest yet most effective trading strategy. They are well trusted by traders, banks and all financial institutions.

Forex Pivot Points Trading Strategy Explained

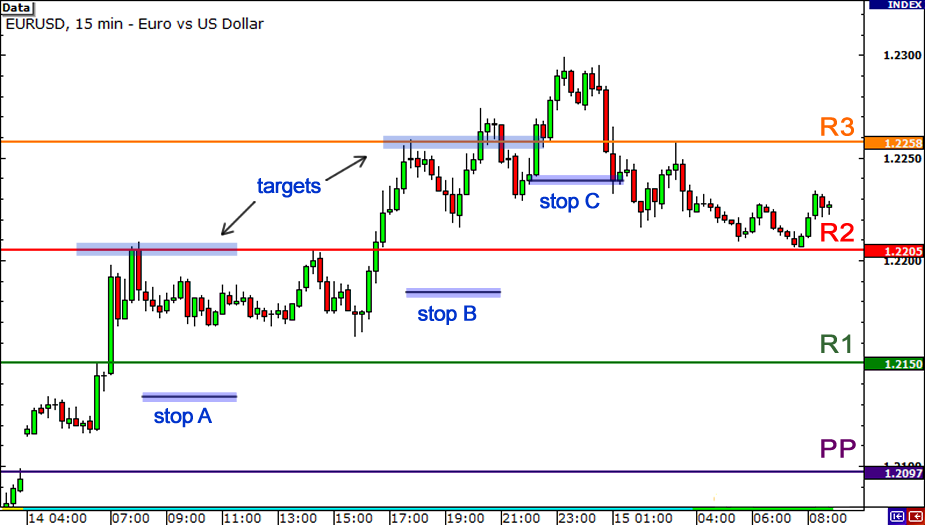

The simplest way to use pivot point levels in your forex trading is to use them just like your regular support and resistance levels. Just like good ole support and resistance, the price will test the levels repeatedly. The more times a currency pair touches a pivot level then reverses, the stronger the level is.

Pivot strategies A handy tool for forex traders

:max_bytes(150000):strip_icc()/dotdash_INV_final_Pivot_Strategies_for_Forex_Traders_Jan_2021-03-3781ad39e9104e469920a8313e63f78b.jpg)

A pivot point is an indicator developed by floor traders in the commodities markets to determine potential turning points. In the forex and other markets, day traders use pivot points to.

Day Trading Strategy For Pivot Points Traders (Forex Trading System For Beginners)

Pivot Points are used to map out support and resistance zones. ⭐ Learn how to use this indicator for trading Forex and CFDs.

How To Trade Pivot Points? Trade Forex With Pivot Points

Pivot points are a technical indicator that traders use to predict upcoming areas of technical significance, such as support and resistance. They're calculated by averaging the high, low and closing prices of a previous period. That could be a day, a week or a month.

Using Pivot Points in Forex Trading (2020 Guide)

It requires only three numbers - close, high, and low. We should first calculate the main daily pivot point. The formula for this: Pivot Point (PP) = (Daily High + Daily Low + Close) / 3. Since the Forex market is a 24/5 market, there is some confusion as to which time to use for the daily market opening and closing.

96. Trading Breakouts using Pivot Points Forex Academy

Pivot points are technical analysis indicators that represent an average of the high, low and closing prices from the prior trading day, and can be used to find likely support and resistance.

Pivot Points Trading Guide (2023) Supercharge Your Trading!

Decades ago, floor trading was the heart of market action. Traders in colored jackets competed for their slice of the cake through shouts, signs, signals and often by sheer physical presence. It.

Using Pivot Points in Forex Trading (2020 Guide)

Pivot points are a technical indicator that traders use to predict upcoming areas of technical significance, such as support and resistance. They're calculated by averaging the high, low and closing prices of a previous period. That could be a day, a week or a month. If a market is trading above its previous pivot point (known as P), it is seen.

Pivot Points in Forex Trading What You Need to Know NOW Forex Academy

Pivot Point Technique in Forex trading is a method of determining most likely support and resistance levels. It is widely used by day traders to establish potential price ranges for the day. It is also used for confirmation of breakouts.. The idea behind trading pivot points is to expect a reversal or break of R1 or S1. By the time price.

Pivot Trading Strategy Easiest Way To Trade Pivot Points Forex Academy

Pivot Point (PP) = (High+Low+Price Close) / 3. Support 1 (S1) = (Pivot Point x 2) - High. Support 2 (S2) = Pivot Point - (High - Low) Once calculated, Forex traders mark these levels on a chart. Daily traders tend to calculate daily pivot points using the data from the previous trading session.