PPT LongTerm Financial Planning and Growth PowerPoint Presentation

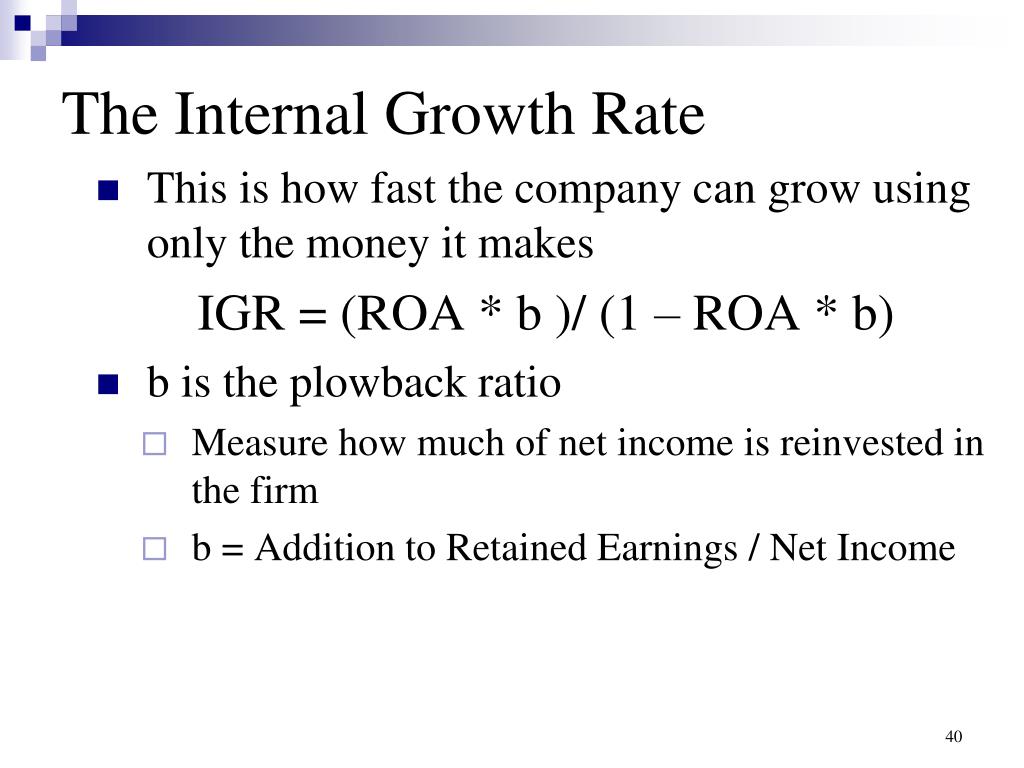

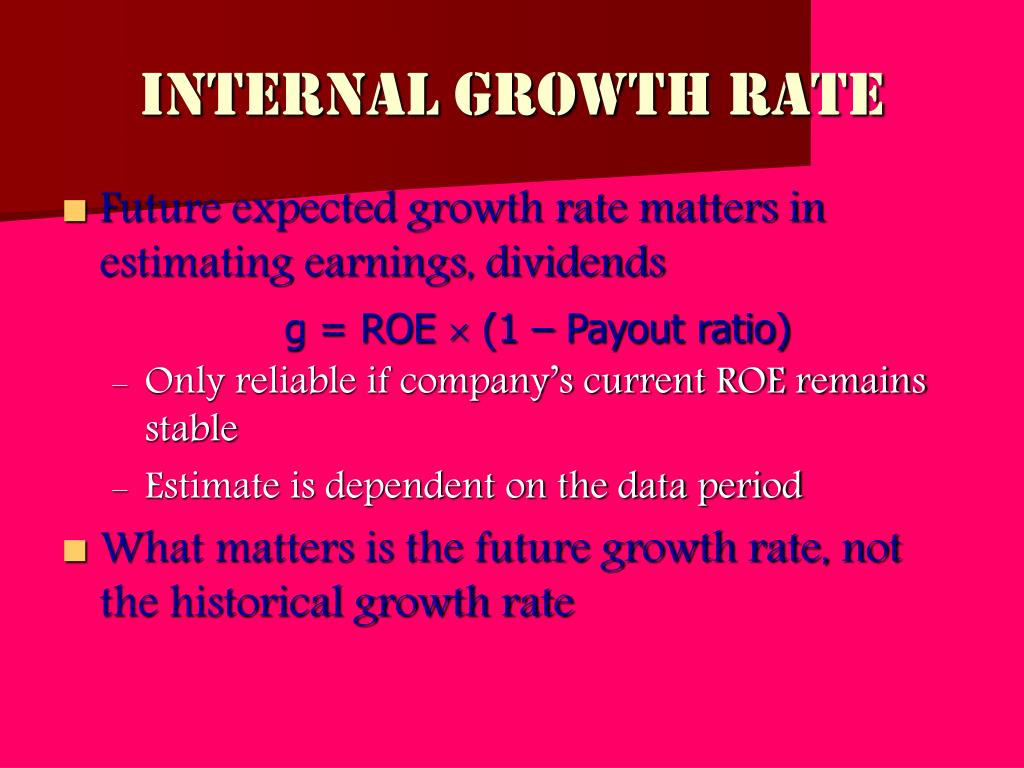

Following is the formula: Internal Growth Rate = Retention ratio x ROA or (1- Dividend payout ratio) x ROA You can also use Internal Growth Rate Calculator. Assumptions for Calculating Internal Growth Rate The dividend payout ratio should be as per the targeted rate. Sales and assets are related proportionally.

How To Calculate Growth Rate From Doubling Time Haiper

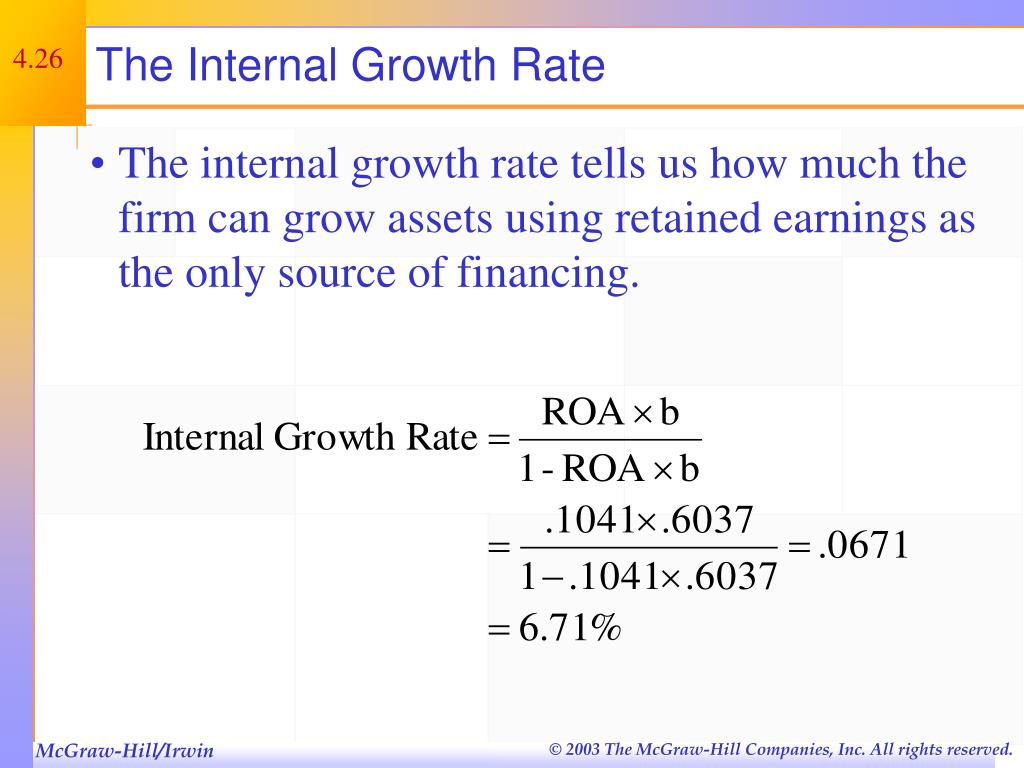

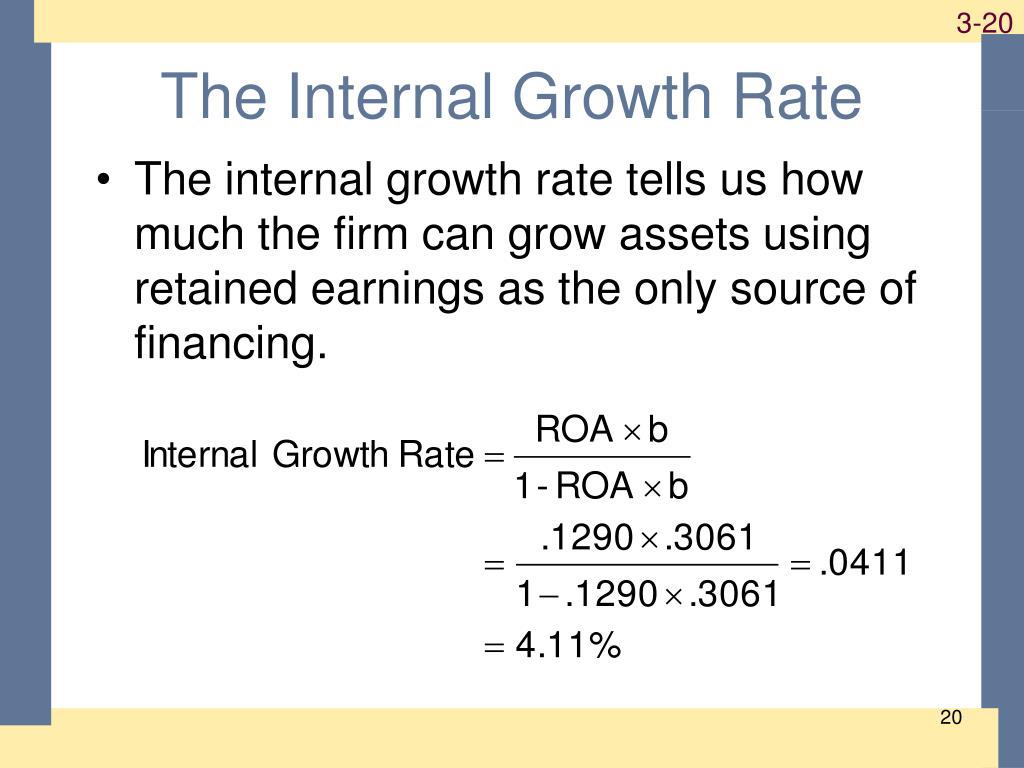

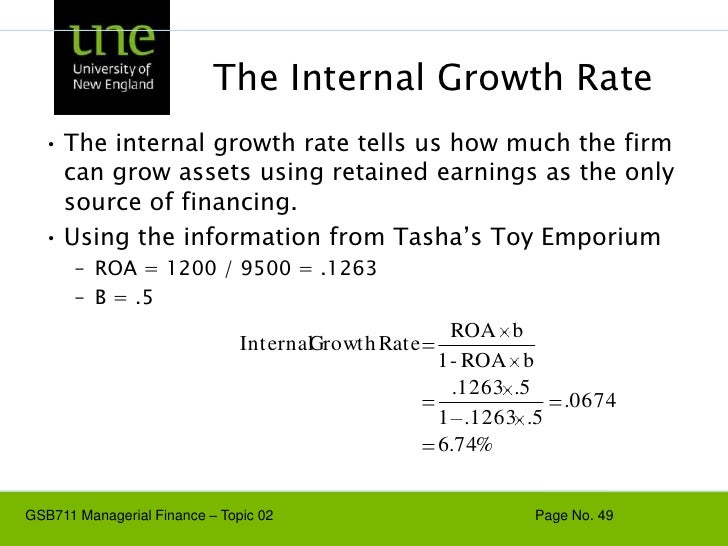

Formula and Calculating IGR Let's take a look at the formula to calculate the Internal Growth Rate (IGR): Internal Growth Rate (IGR) = ROA.B/ [1- (ROA.B)] Where: ROA = Return on Assets B = The Retention Ratio Before calculating, one must determine the return on assets and the retention ratio.

Rev Up Your Revenue Maximizing Sales Growth Rate in 2023

The Internal Growth Rate (IGR) estimates the maximum rate that a company could grow using solely its retained earnings without external financing. How to Calculate Internal Growth Rate? The internal growth rate (IGR) sets a "ceiling" on the maximum growth rate achievable for a specific company, assuming it does not obtain any external financing.

What is Internal Growth Rate (IGR)? Formula + Calculator

IGR (Internal Growth Rate) Calculation Return on assets : Retained earning rate : Reset Internal Growth Rate : Formula: IGR = (ROA × b) / (1 - ROA × b) where, ROA - The Return on Assets - is the annual net profit divided by the average book value of assets at the beginning and end of the year. b - retained earning rate IGR - internal growth rate

What is Growth Rate? Formula + U.S. Population Calculator

How Is IGR Calculated? Below is the internal growth rate formula: IGR= (RoA⋅b)/ (1− (ROA⋅b)) Where: RoA = Return on assets b = Retention Ratio Confused? Let me explain the terms. Return on Assets (RoA) Return on assets is the net income expressed as a proportion of the total assets owned by the firm.

What is Internal Growth Rate (IGR)? Formula + Calculator

Internal growth rate (IGR) is the level of growth achieved without using external financing like debt. It is the growth rate that a business or investment can produce using internal resources. In business terms, it is the sales growth supported by the core operations of a business without issuing more stocks (Equity) or bonds (Debt).

Chapter 4 Internal Growth Rate and Sustainable Growth Rate YouTube

The Internal growth rate of a firm depends on the retention (plowback) ratio (RR) (RR) and the return on assets (ROA) (ROA) using the following growth rate formula: g = \displaystyle \frac {ROA \times b} {1 - ROA \times b} g = 1−ROA×bROA×b. The plowback ratio is a very interesting measure that indicates how much a company is retaining for.

Internal Growth Rate (or IGR) is the maximum growth rate that the

The formula to calculate the Internal Growth Rate is as follows: Internal Growth Rate = Retained Earnings / Total Assets Or Internal Growth Rate = (Retained Earnings / Net Income) * (Net income / Total Assets) So Internal Growth Rate = Retention Ratio * ROA The retention Ratio is the rate of earnings that a company reinvests in its business.

Internal growth rate What is it exactly [+ formula]

The internal growth rate refers to the sales growth rate that can be supported with no external financing. The internal growth rate is important, particularly for smaller businesses or start-ups, since it measures the company's ability to increase sales and profit without issuing more stock or debt.

PPT Financial Statements PowerPoint Presentation, free download ID

Internal growth rate (IGR) is a metric used to measure a company's organic growth. It is calculated by multiplying the company's retention ratio by its Return on Assets. IGR is significant because it measures ability to grow without new customers or new investments.

PPT Chapter 17 PowerPoint Presentation, free download ID6402011

How to calculate IGR The internal growth rate (IGR) is derived from specific financial metrics, primarily the company's return on assets (ROA) and retention ratio (RR). The primary formula The IGR formula: Return on assets x retention ratio.

Internal Rate of Return (IRR) Definition, Formula & Example Tipalti

The internal growth rate is the rate of growth that the company can attain only with the help of its internal operation. It is the growth rate attained by the company without taking into effect the impact of any financial leverage in the form of debt funding.

Internal Rate of Return Formula How to Calculate IRR

The Internal Growth Rate (IGR) is a financial metric used to calculate the maximum rate at which a company can grow its sales and assets without external financing. IGR helps businesses determine their sustainable growth rate and make informed decisions about reinvesting profits back into the company or seeking alternative sources of funding.

How To Calculate Percentage

Formula and Calculating IGR To calculate the Internal Growth Rate for a company, you have to determine two variables. First, you need the company's Return on Assets (ROA), which is: Net Income.

PPT Chapter 3 PowerPoint Presentation, free download ID5411598

Internal Growth Rate = Retained Earnings / Total Assets Turnover Where: Retained Earnings: The portion of a company's earnings that is reinvested into the business. Total Assets Turnover: The ratio of net sales to total assets. The internal growth rate is usually expressed as a percentage. Applications:

GSB711LectureNote02UnderstandingFinancialStatements

Formula Internal growth rate can be calculated using the following formula: Internal Growth Rate = Retention Ratio × ROA Internal Growth Rate = (1 - Dividend Payout Ratio) × ROA Understanding the Math Every dollar of earnings reinvested becomes a dollar of assets.