Autoloan defaults lowest in at least 11 years MarketWatch

What Does It Mean To Default on an Auto Loan? Defaulting on an auto loan means you have missed a payment or stopped paying back what you owe on your car. To pay off a loan from a.

Your Complete Guide to Car Loan Rates Hubpots

By Sean Tucker 05/23/2022 9:30am. In March, 8.5% of subprime borrowers defaulted on their car loans, according to Equifax. That's the second-highest total on record. The Wall Street Journal.

Second mortgage and bank card defaults spike as spending rises

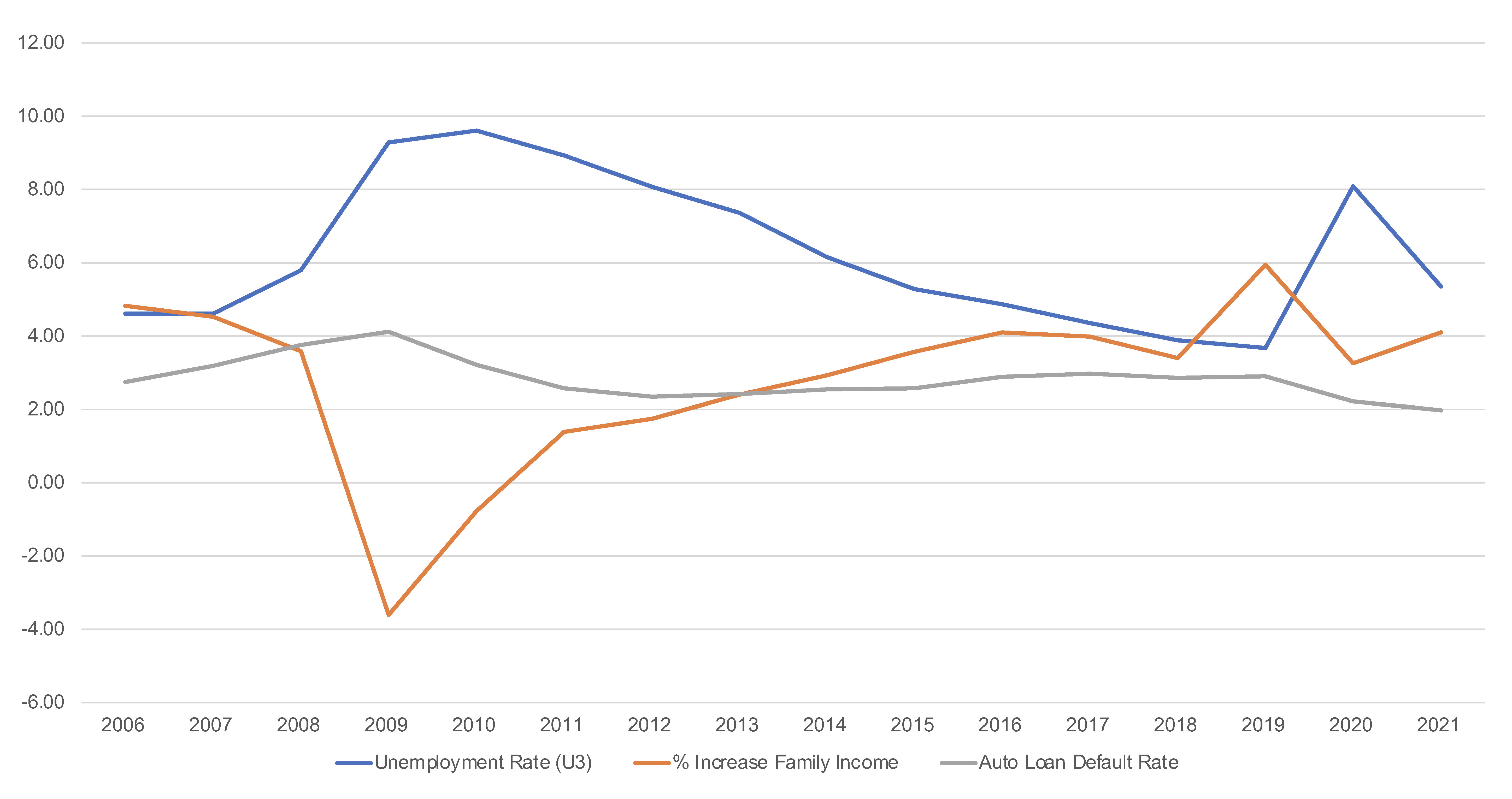

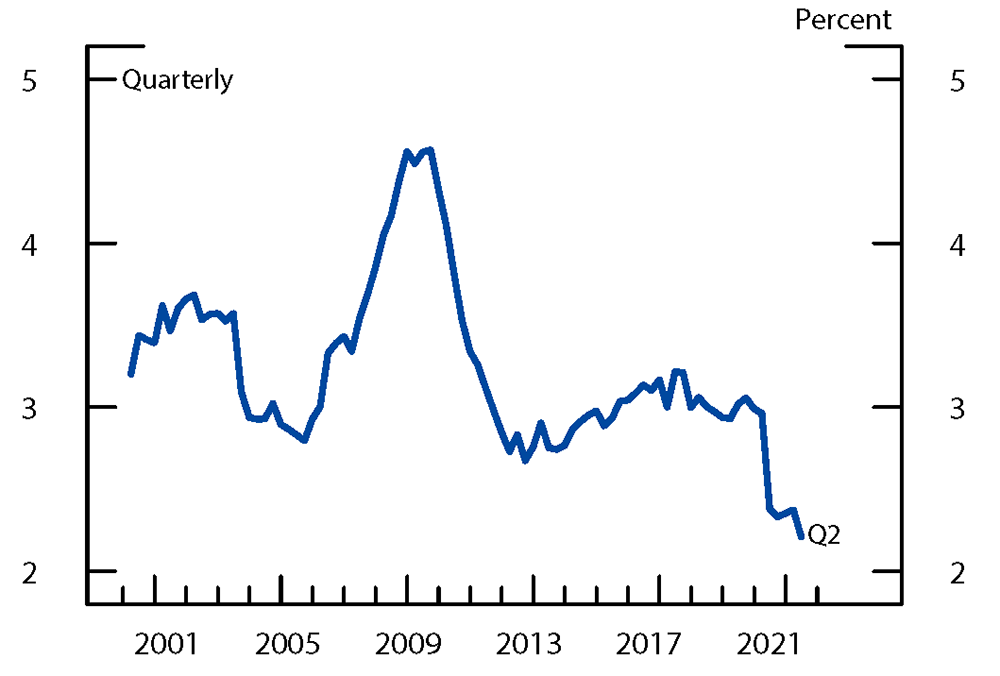

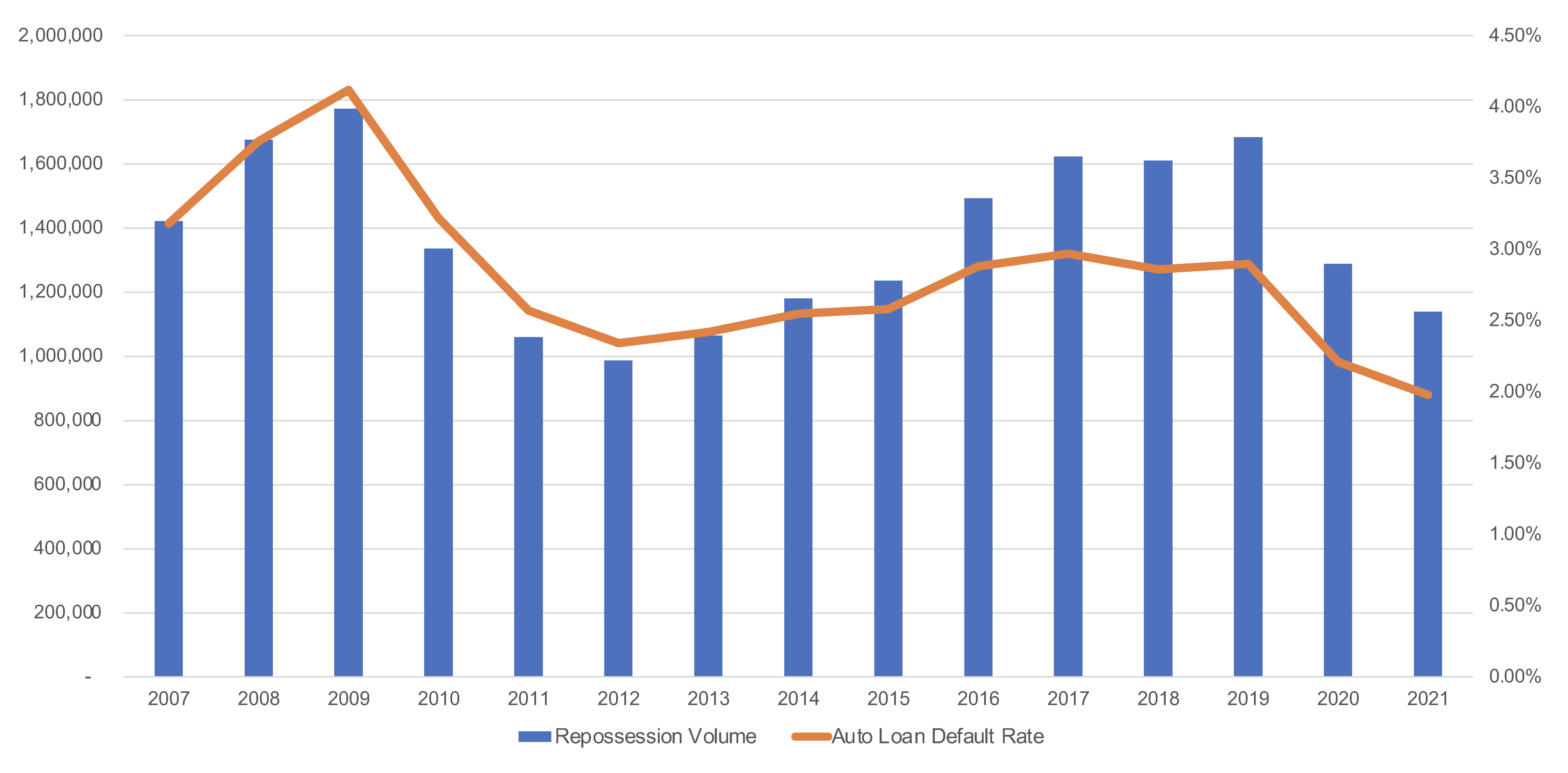

In 2019, our estimates indicate there was a decade-high 2.1 million auto loan defaults, pushing the loan default rate to 2.9% of all loans. In 2020, thanks partly to loan accommodation and government stimulus, auto loan defaults dropped to 1.6 million, or 2.2% of loans.

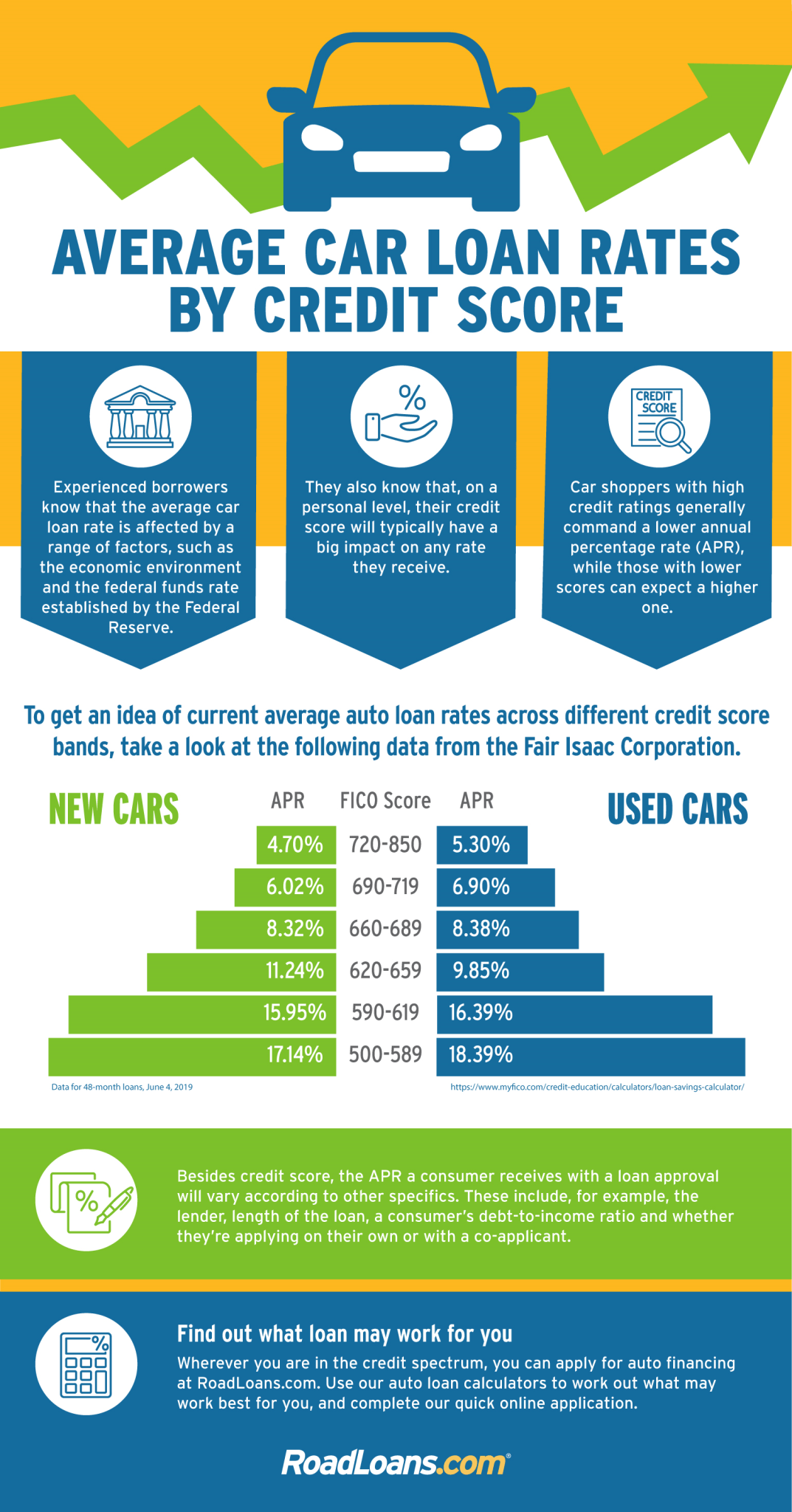

Check out average auto loan rates according to credit score RoadLoans

The average interest rate for a 60-month new car loan reached 7.48% in Q1 2023, up from 4.52% a year before. Interest rates for 72-month new car loans increased from 4.54% in early 2022 to 7.48% at the beginning of 2023 [4]. Navigate the auto finance landscape with our post on 'Car Loan Statistics 2023'.

Auto Default Rate Rises

Auto Loan Default Statistics 2022-2021 Defaults increased from auto loan lending standard decay. Q1-2020-to-Q2-2021 auto loan defaults rose from 4.17% to 4.64%. Millennial-driven increases in delinquencies lasted from 2014 to 2021. Subprime 90-days-overdue-or-greater defaults rose to decade-long high in 2021-2022.

Subprime Auto Loan Default Rates Are Now Higher Than During The

The average auto loan interest rate for new cars is about 7%, and for used cars, it's around 11%, according to Experian's State of the Automotive Finance Market report. But if your credit.

Current Auto Loan Rates + Best Lenders of 2021 Finder

The average rate on new car loans in November was 7.4 percent, up slightly from the start of the year, according to Edmunds.com. Used-car rates were even higher: The average loan carried an 11.6.

Auto Loan Defaults Are Increasing, But We Are Not Heading Into A Repo

. The last time this many drivers were delinquent on their auto loans was when the first mobile flip phone entered the market — in October of 1996. That's according to new data from Fitch.

The Fed Delinquency Rates and the “Missing Originations” in the Auto

Mar 1, 2023 - Economy Low-income households are falling behind on car bills Matt Phillips , author of Axios Markets Data: S&P Global; Chart: Axios Visuals Consumers with low credit scores are falling behind on their auto loans at a record rate.

Auto Loan Defaults Are Increasing, But We Are Not Heading Into A Repo

The Fed reports that the average auto loan is now $24,000, up 41% from 2019's value of $17,000. Image: Visual Capitalist. We can see that Americans under the age of 40 have grown their vehicle-related debt the most.

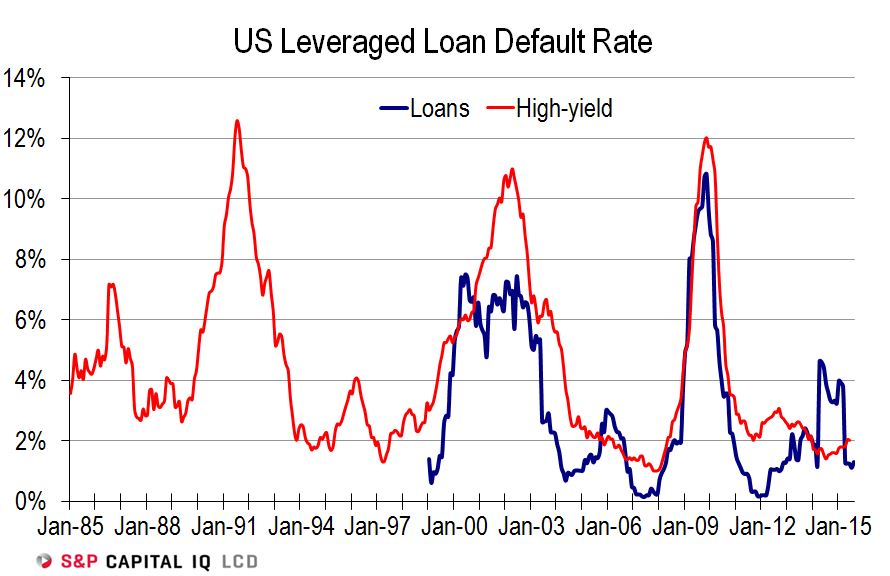

Leveraged Loan Default Rate Expected To Rise, Though Only Modestly S

Generation Z and millennials today have auto loan delinquency rates that are significantly higher than their prepandemic levels, according to new data from the credit reporting agency.

Auto Loan Default Rates Rise

Declines are modest so far. The average new car loan rate almost reached 10% in October and is now down to 9.6%. The average used car loan rate peaked at 14.4% in mid-November and is now down to.

Mortgage default rates inch up closer to yearago levels National

. While vehicle prices have been going up, auto loan delinquency rates have remained surprisingly low for the first two years of the pandemic. Unfortunately, this is no longer the case.

When will leveraged loan default rates finally rise? Here's What Loan

Default rates have reached record highs, suggesting that many Americans are having trouble repaying their auto loans. Roughly 5% of auto loans were 90 days delinquent or more in the second quarter of 2020 — the highest 90-day loan delinquency rate in more than seven years — according to data from the Federal Reserve Bank of New York.

Auto Loan Rates NY 100 APPROVAL RATE Auto Loan Rates NJ YouTube

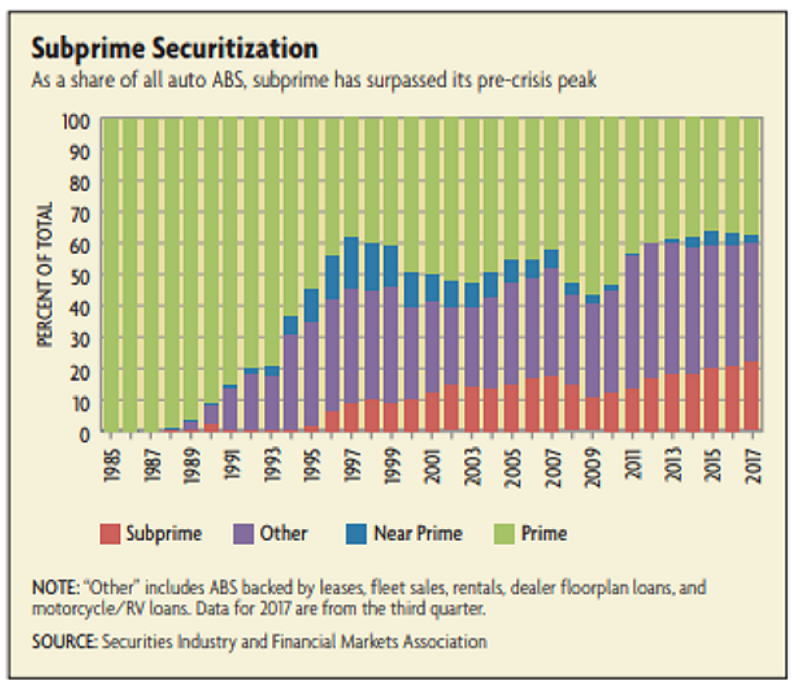

Borrowers with subprime auto loans typically pay high interest rates and frequently default on their loans. Interest payments could compensate lenders for borrowers' default risk, and so the high interest rates paid by borrowers with subprime loans could b e explained by their higher default r ates. 5

Social Media Is Fueling the Auto Loan Default Rate Bubble And

According to the consumer financial website NerdWallet, the average auto-loan interest rate in the third quarter of 2023 was 7 percent for new cars and 11 percent for used cars.